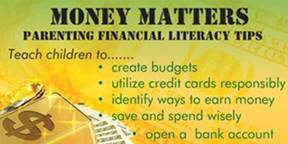

The unwise financial patterns of some parents all too often emerge in the lives of their children. The financial decisions made early in life repeatedly affected one’s ability to become a financially secure adult. Financial tasks related to credit, insurance, taxes, homeownership, and investments were often not practiced until young people left home. Having children acquire competence in financial literacy is important for them to function effectively in society.

Financial Literacy is the modeling and teaching of financial tasks in the home; it encourages parents to teach, delegate, or distribute financial responsibilities to children at an early age for them to become financially responsible and independent as adults. It is valuable to all ages. It is a process that occurs over the entire life cycle, but awareness of responsible principles is important for young people because it likely translates into competency in financial matters as adults.

Are you ready to take the GMP Parent Financial Literacy Pledge? What financial literacy tips would you like to share with other parents?

Comments